Assess the Risk and Take Action Intelligently

Law firm executives get weekly and monthly reports on the status of your firm’s compliance with billing guidelines. Identify the clients and timekeepers with the most revenue at risk, so that you can take action before it results in revenue loss for your firm.

For the first time, executives and financial managers at the firm can have true visibility into the dollars at risk at their firm due to non-compliance. This not only brings compliance to a level that has never before been possible, but also allows management to assess the areas most at risk (whether a client or timekeeper), address them in a timely manner and make informed decisions. In addition, financial managers can now view the ROI of implementing OCG Live.

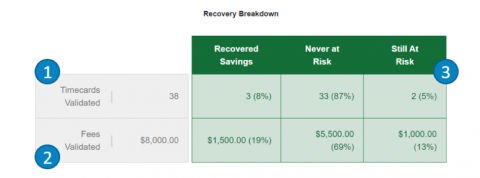

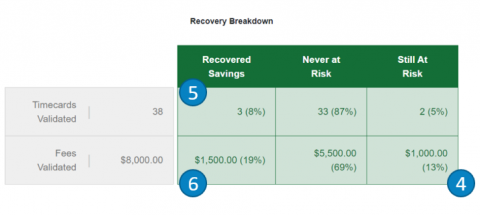

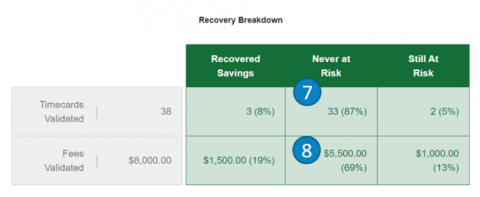

Understanding the OCG Financial Report

1 – What does Timecards Validated mean?

- Timecards that met at least 1 guideline filter

2 – What does Fees Validated mean?

- Dollar amount associated with Timecards Validated

3 –What does Still At Risk mean?

- Timecards with ≥ 1 Issues on them

4 – What does Fees Validated: Still At Risk mean?

- Dollar amount for Timecards at Risk

5 –What does Timecards Validated: Recovered Savings mean?

- Number of timecards that had 1 or more issues and now have none

6 – What does Fees Validated: Recovered Savings mean?

- Dollar amount for Timecards Recovered

7 – What does Timecards Validated: Never At Risk mean?

- Timecards met filters but had no warnings/errors

8- What does Fees Validated: Never at Risk mean?

- Dollars that were never in jeopardy